Their unfunded loan harmony associated with three design loans was $step one,202,480 as of

The firm then followed CECL towards . This new allocation having borrowing from the bank loss is made as a consequence of a provision having loan loss billed in order to expense, hence directly impacts all of our money. Loans is actually billed from the allocation when the Providers believes one the fresh new collectability of all otherwise some of the dominant are unrealistic. Subsequent recoveries is set in the newest allocation. The credit Loss Expenses ‘s the costs to help you doing work money requisite to maintain a sufficient allotment having borrowing from the bank losses. The firm consistently feedback these procedures and functions and you may renders next advancements as required. Yet not, their methods may well not correctly estimate inherent loss otherwise exterior factors and you can switching economic conditions could possibly get affect the financing profile and you may the level of supplies with techniques currently unexpected.

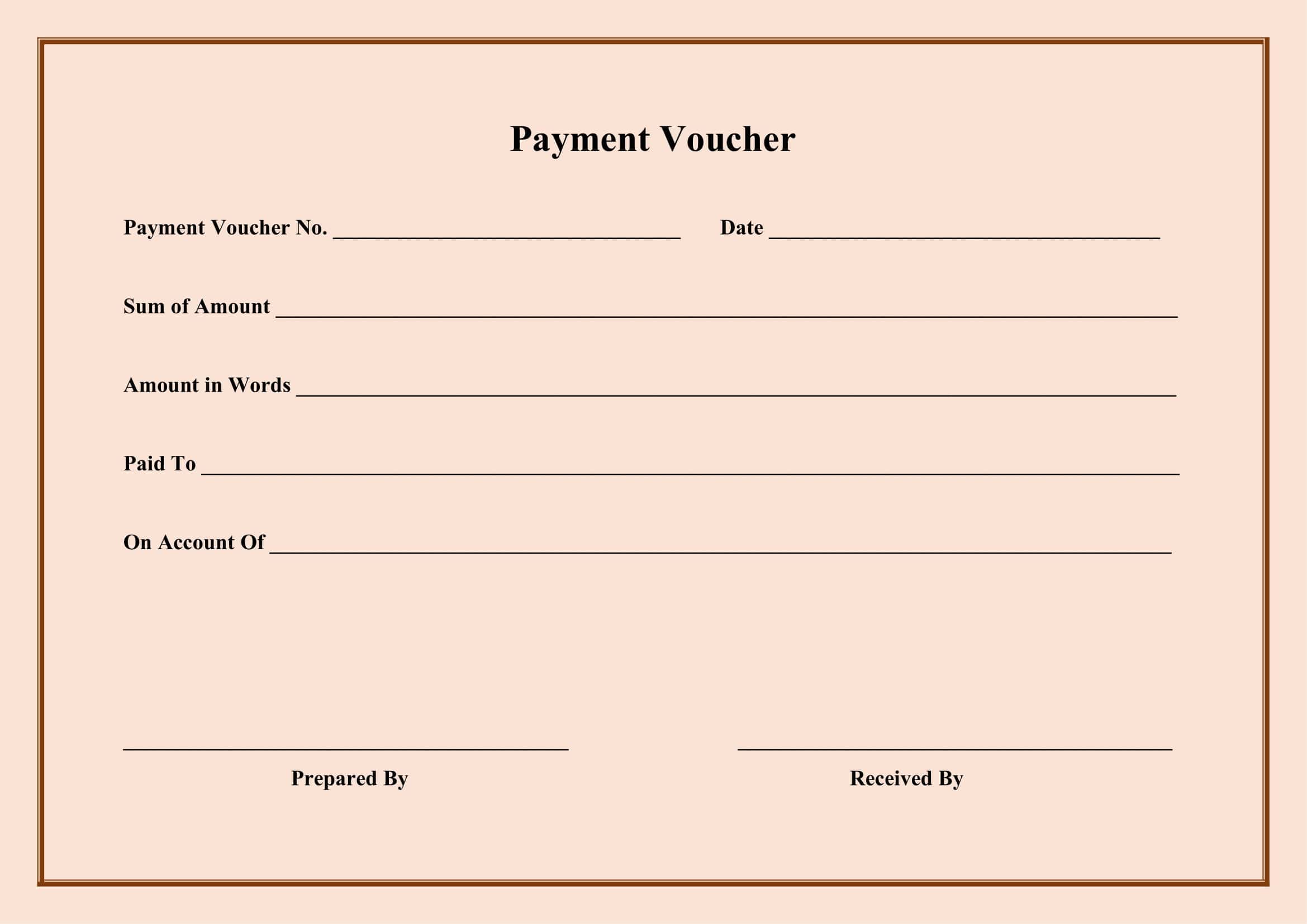

On regular span of functions, the firm partcipates in financial transactions that, in line with generally approved accounting beliefs, aren’t registered regarding the financial statements. Wants money are published to the business because of the borrower toward A1A G702 Application and you may Certificate getting Commission mode (“Draw Plan”). The company occasionally uses an inspector to visit the development site to review new advances to the venture and you will verify brand new part of conclusion of every component of new Draw Schedule.

The company brings up resource from issuance off Show A well liked Shares with a first stated worth of $ten for each and every display. Away from The beginning (, the company provides raised $23,941,590 (net out of redemptions) from funding through the issuance of Classification A series A popular Shares with their Controls A beneficial Offering. When you look at the exact same period, the company approved 114,037 Shares off Classification A sequence A well liked Added bonus Offers (web of forfeitures via early redemption).

You will find establish formula and functions for comparing all round top quality of our own loan portfolio in addition to punctual personality away from situation money

The organization informed the SEC into the of your intent supply Group B, C, and you may D Ties owing to a limitation D 506c providing (“Reg D 506c”). Since , the company enjoys elevated $step 1,688,000 from issuance away from Collection A well liked Offers from Reg D 506c giving. While in the 2023, the organization closed a wedding Agreement getting MIT Lovers LLC “MIT” because the personal financial advisor and you will direct position broker into the union with Reg D 506c solicitation security providing away from Series A favorite Shares.

The company submitted an article Providing Statement to have degree old so you can offer up to help you $75,000,000 your Collection A preferred Shares.

Especially, the company disburses loan continues for the a property construction money according to preset goals pertaining to the improvements of the build enterprise

The business has no debt burden it is examining options for obtaining a line of credit. A credit line gives liquidity to own overtaking development options. Whenever used smartly, a line of credit can increase money by allowing us to obtain on a lower life expectancy rates and you may lend that money away at a higher rate, promoting a profitable pass on and you will enhancing total returns. In the event the a line of credit was covered, i propose to use the line of credit to originate finance, secure lender fees, and you may after that sell the fresh new funds so you’re able to americash loans Naples third parties, allowing me to pay off the new line and you may reinvest inside the the latest possibilities. Management’s objective is always to secure a line of credit around $5,000,000 about 4th quarter out of 2024 and/or basic one-fourth out-of 2025. The newest credit line was shielded from the an effective subset away from our very own money. The amount of obligations will not surpass sixty% of the financing balance.

We require capital to cover the funding products and you can working expenses. All of our sources of resource consist of internet arises from all of our coming Offerings, earnings off functions, internet arises from resource money and you may sales and you will borrowings around borrowing facilities.