Second House Build Loan: All you need to See

For those who as well as your nearest and dearest enjoys longed-for a destination to get off the new hectic, non-prevent activity away from day to day life, you could start thinking out-of managing the next home otherwise vacation possessions. Or, maybe you may be a trader trying to manage a reliable income weight of the creating a holiday house which are hired out while in the the entire year.

http://cashadvancecompass.com/payday-loans-il/lawrence/

Design the best beachfront home, vast river household, austere cabin, or upscale barndominium needs more than just an aspiration it will likewise want reputable financial support.

A moment house construction loan is the perfect choice for strengthening a holiday property or 2nd home for the Southern area Tx that meets your unique demands. Discover how domestic build financing really works, the loan recognition procedure, and just why Tx Gulf of mexico Bank is the best credit spouse for building your next family in the region.

The basics of Second Household Build Fund

Structure financing for 2nd home is short-label financing solutions that provide the credit to construct the actual possessions, that have some high rates of interest and you may a shorter payment screen opposed to many other conventional financial items. These types of financing funds the expenses of the building a beneficial next home otherwise travel assets, that become:

- To shop for home

- Standard contractor

- Designer and blueprints

- Laborers

- Construction material

- It permits

This type of fund vary from conventional mortgage loans in many ways. Usually a possible family client searches thanks to the offered a residential property options for a primary house immediately after which starts the application process with a lender.

However, which have second family structure finance, possible borrowers earliest need safe a creator, next proceed through an affirmation procedure. Make an effort to complete this strengthening preparations, a thorough framework timeline, a detailed funds, and related economic records.

In the event that approved, the lending company produces commission distributions (age.grams. draws) straight to the newest specialist whenever specific structure milestones is fulfilled. That it ensures that the capital happens in person towards the build therefore the domestic will be done as near to the projected prevent big date as possible.

During the structure stage, individuals are only responsible for paying interest towards the money removed during the building mortgage. Having a construction-just financing, brand new borrower is responsible for paying the mortgage completely whenever design is carried out otherwise making an application for a traditional mortgage to help you safer permanent financing to the full amount borrowed.

There are a few dangers that come with creating the second home in the floor upwards. Before applying for a property mortgage, think factors instance:

- Design timelines

- Work otherwise question shortages

- Current interest rates

Environment situations, have strings interruptions, and you will labor shortages can result in big delays when you look at the construction. On top of that, fluctuations in the rates should be felt prior to starting a moment household construction application for the loan.

All these issues is also somewhat affect the design of your own household, along with your capacity to pay the borrowed funds.

What to expect For the Mortgage Acceptance Processes

If you work on Tx Gulf Bank for 2nd family design resource, we shall begin the method having a first evaluation to choose your existing financial condition and you can capacity to repay the borrowed funds. Funds to possess 2nd home pose a top chance for loan providers, therefore the recognition processes is a little more in depth and you can tight than simply an elementary home loan app.

We ask one to individuals meet multiple monetary requirements to be eligible for a construction loan, together with having their project agreements accepted ahead of time. On the 1st testing to choose for individuals who qualify, we will opinion another pointers:

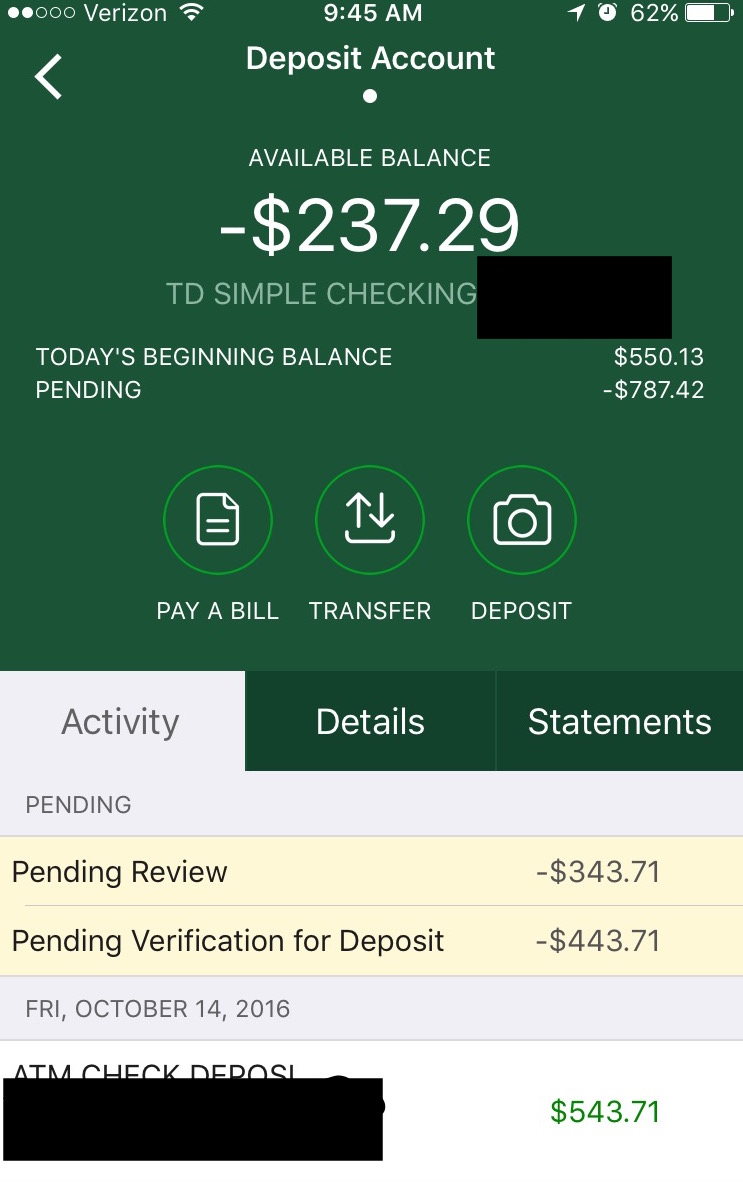

A healthy credit score is recommended to have 2nd home framework financing candidates. Along with, we’re going to verify that you could cover the required downpayment on framework loan. To examine your own certification, we are going to request another monetary records:

Concurrently, a push-of the inspection is also the main 2nd family build mortgage process to verify there aren’t any most other developments becoming generated to the the property. In the event the there aren’t any identity otherwise valuation items, the common mortgage recognition techniques out-of app to capital was anywhere between 29 in order to forty-five weeks that have Colorado Gulf Lender.

Immediately after accepted, their creator begins researching pulls into design financing to help you purchase all the some other stages regarding construction.

As to why Choose You for your Next Family Construction Loan?

Your dream vacation oasis could become possible to the assist regarding one minute home framework loan as a result of Colorado Gulf coast of florida Lender. With more than 100 numerous years of feel, we are a strong, reputable, economically safe local financial which is invested in strengthening enough time-lasting matchmaking with your clients whilst bringing exceptional provider.

Our next domestic design funds are made to see your unique requires. We off educated loan officers helps you understand the readily available resource options, following get you off and running on the loan application processes.

Due to the fact a district lender, we well worth the capacity to hook that assist people with each step of your financing investigations and application process. You might usually talk to a lender an identical go out so you’re able to discuss the second domestic construction goals and you will investment means.

On the other hand, all of our proximity for the Gulf of mexico Coastline offers our team even more insight into the dangers and you may perks that are included with building a moment house in this area, such as for example weather events, floodplain elements, and you will environment conditions that you can expect to change the defense and cost off your second household.

Isn’t it time to begin with strengthening another house you’ve usually longed for? Texas Gulf Lender makes it possible to get a hold of another family build financing that’s true to you.