Do HUD 232 Financing Want Financial Insurance policies (MIP)?

Sure, HUD 232 financing need consumers to invest an MIP (Mortgage Advanced), while the both a-one-some time a yearly expense. MIP of these funds boasts a 1% single MIP comparison, payable at closure, and you can an effective 0.65% annual MIP charges, paid back annually.

- Would you like Home loan Insurance policies to have an effective HUD 232 Mortgage?

- What is actually MIP?

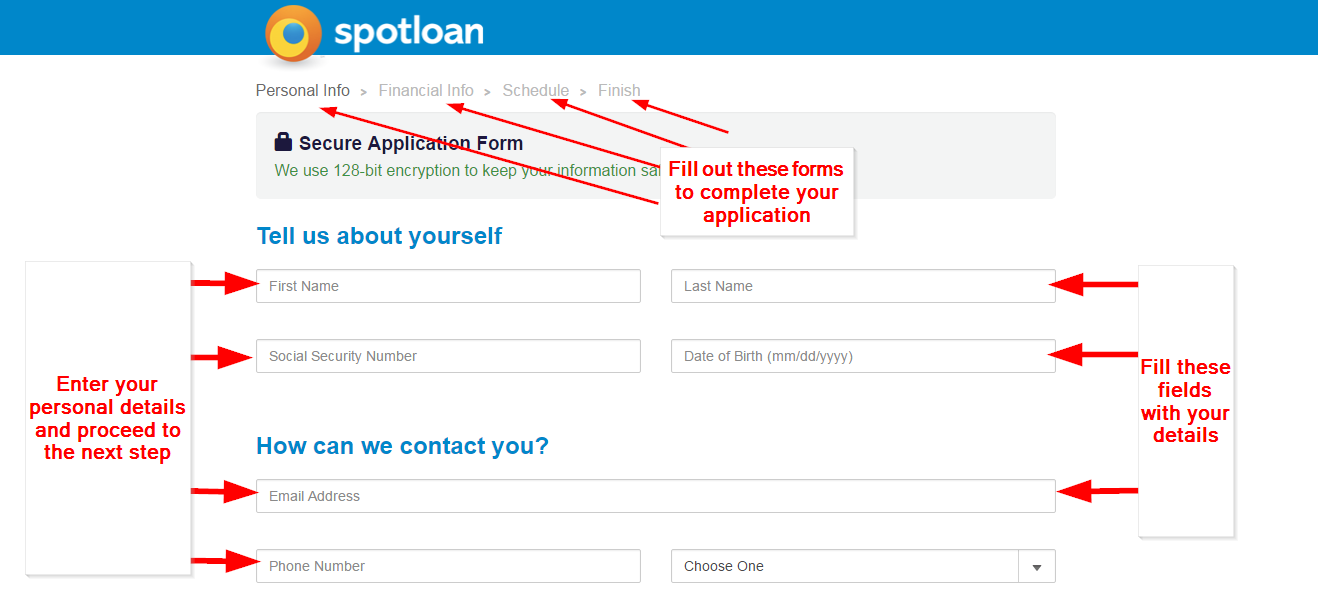

- To learn more about FHA 232 finance, fill out the shape lower than to dicuss so you’re able to good HUD/FHA mortgage specialist.

- Associated Concerns

- Rating Capital

What is a beneficial HUD 232 loan?

An effective HUD 232 loan is financing insured from the You.S. Institution of Housing and you will Metropolitan Invention (HUD) which is used to finance the development and you can rehabilitation off establishment getting older some body requiring healthcare and other a lot of time-label care, in addition to purchase and you may refinancing off older-focused medical care characteristics. HUD-kept fund try funds which can be held by HUD and they are included in relation to FHA 232 financing. To learn more about HUD 232 loans, please fill in the proper execution on our web site to talk to a great HUD/FHA loan expert.

What exactly is mortgage insurance policies (MIP)?

Home loan Advanced (MIP) was an annual percentage into the an excellent HUD mortgage, reduced within closure, for each and every 12 months away from structure, and you will per year. To own HUD 223(f) money, MIP was twenty five foundation circumstances getting attributes having fun with an eco-friendly MIP Protection, 65 foundation things to own markets price features, forty five foundation facts having Part 8 otherwise the newest money LIHTC qualities, and 70 basis facts having Area 220 metropolitan revival systems you to are not Area 8 or LIHTC. To possess HUD 232 funds, MIP was step one% of amount borrowed (due on closing) and you can 0.65% a year (escrowed month-to-month).

MIP is an important consideration when looking at HUD loans. It is a variety of insurance policies one to handles the lending company out of losings you to exists when a debtor defaults. While you are initial and you may annual MIPs was will set you back you should examine when examining your loan alternatives, it is possible to get rid of all of them – as well as versus a reduction, HUD loans will always be generally way less costly than other items regarding multifamily obligations, also Federal national mortgage association and you will Freddie Mac financing.

Is HUD 232 financing necessary to enjoys home loan insurance policies (MIP)?

Yes, HUD 232 money require borrowers to invest a mortgage Top (MIP), once the one another a single-some time and a yearly expenses. MIP of these financing includes a-1% single MIP testing, payable in the closure, and you can a beneficial 0.65% (65 base issues) annual MIP charges, reduced each year to own sector rate qualities. Concurrently, HUD allows another changes:

- 0.45% (forty-five basis affairs) getting Point 8 or the fresh currency LIHTC characteristics

- 0.70% (70 base facts) to have Area 220 metropolitan revival tactics (non-Area 8 and you can non-LIHTC strategies)

An FHA app fee off 0.30% of whole loan amount is also expected, and a keen FHA assessment payment away from 0.50% of your amount borrowed (in the event this really is funded on mortgage equilibrium).

Which are the benefits of a good HUD 232 mortgage?

- HUD 232 refinancing out of numerous properties is also significantly boost cashflow, probably providing designers the administrative centre to purchase or build the brand new possessions

- HUD fixed-rates capital lets high businesses in order to balance out expenditures and also make specific economic projections better for the future

What are the standards for an excellent HUD 232 mortgage?

In order to remove a HUD 232 or HUD (f) financing, a borrower need certainly to normally have experience properly doing work a minumum of one place of the identical kind which they want to create otherwise buy. At exactly the same time, a debtor must getting prepared as the just one house, special-purpose entity (SPE). Eligible individuals can either getting a for-profit otherwise a low-cash entity.

In order to be eligible for HUD 232 money, characteristics need meet different eligibility conditions, and offering persisted proper care, becoming appropriately subscribed, and having about 20 people.

Below is actually an outline regarding insurance criteria to possess HUD 232 investment. HUD’s detailed standards to have insurance coverage toward Section 232 money are found when you look at the Section 14 of Healthcare Mortgage Insurance coverage System Guide (4232.1).