Convince Lenders Review: You will be Able to Snag Biggest Deals When selecting an excellent New home

It pleasure themselves towards knowing how the father or mother organizations build timelines works so that your house (and) mortgage stay on schedule.

This means you may be able to get hold of a minimal home loan rate one external loan providers just can’t overcome.

Continue reading for additional information on these to determine if they would be a great fit for your financial needs.

Promote Mortgage brokers Even offers Huge Speed Buydowns

- Direct-to-user home loan company

- Even offers household buy money

- Dependent into the 2016, based in the Newport Beach, Ca

- An entirely possessed subsidiary out-of Century Communities

- Mother organization is in public areas exchanged (NYSE: CCS)

- Registered to lend in 18 claims nationwide

- Funded about $dos million home based funds from inside the 2022

- Very energetic inside California, Tx, Georgia, and you can Texas

- And operates a subject team and you can insurance company

Promote Home loans try an entirely owned part off Century Teams, which provides so you can-be-depending and you may short disperse-during the land during the a small number of claims nationwide.

The top attract is providing home purchase funds in order to buyers from newly-depending house regarding many teams it efforts on the nation.

He or she is licensed in the 18 says, and Alabama, Arizona, Ca, Texas, Florida, Georgia, Indiana, Louisiana, Kentucky, Michigan, Las vegas, nevada, New york, Ohio, Sc, Tennessee, Colorado, Utah, and Washington.

The same as almost every other creator-affiliated loan providers, Encourage Mortgage brokers and additionally operates a subject insurance rates and you can settlement company called Parkway Term, and you will an insurance agencies called IHL Homeowners insurance Institution.

This means you certainly can do one to-stop trying to find all of your current home loan means, in the event it is usually sensible to search available for such third-cluster qualities also.

How to start off

You can either visit a Century Communities brand new home sales office discover matched with financing administrator, or perhaps go surfing.

For folks who see their website, you could potentially click on Pre-be considered Now to access a loan officer list you to definitely lists the many organizations manage from the their mother or father business.

Just after seeking your state, possible get a hold of a residential area to determine what mortgage officials serve that certain advancement.

From there, you will see contact information and you might have the ability to rating pre-entitled to home financing otherwise log in if you’ve currently applied.

Their digital loan application is running on fintech business nCino. It allows one eSign disclosures, connect financial accounts, and you will finish the software away from people unit.

You can lean on your own dedicated, human mortgage group which can be found to assist and offer responses once you enjoys concerns.

They look to offer a harmony from both technical and you can individual touching to cause you to the end range.

And because he could be affiliated with the fresh new creator, they’ll certainly be able to discuss easily and maintain the loan towards tune according to framework status.

Loan Programs Given

With regards to financing selection, they will have every biggest loan apps a house consumer you certainly will you need, and additionally conforming funds, jumbo fund, and the full selection of regulators-backed money.

Brand new Ascent Club

This could become learning how to save yourself to possess a downpayment, how to attract resource supplies, just how to improve fico scores, plus alter your DTI ratio.

And you may whether you’re a primary-time domestic client otherwise veteran, it run free webinars to resolve people home loan questions you’ll be able to has.

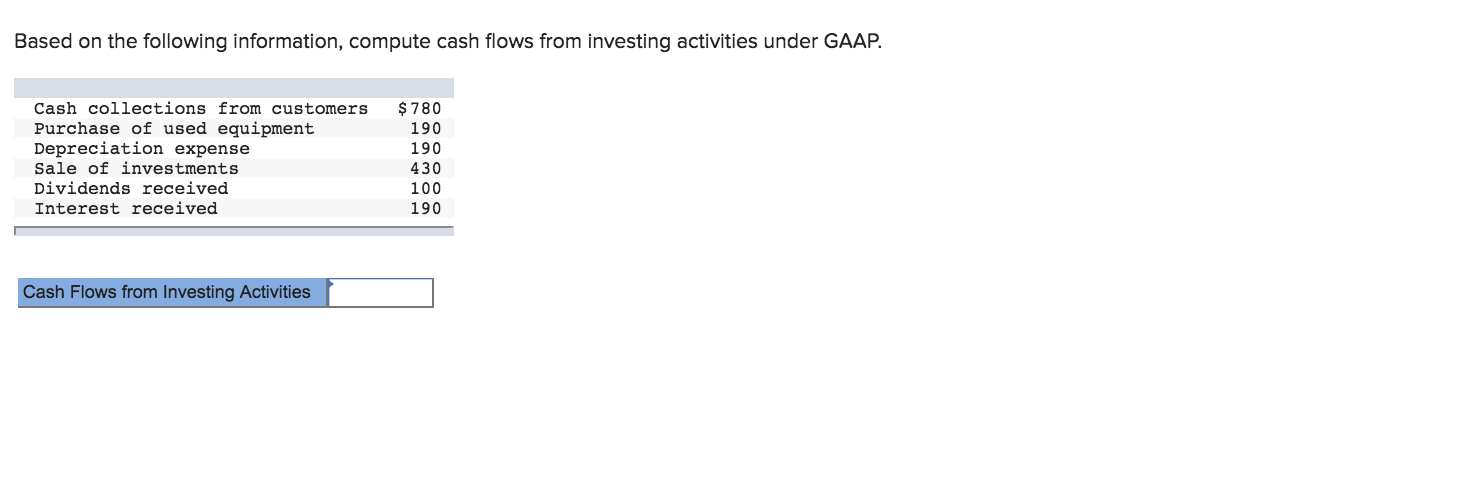

Convince Lenders Cost and you can Fees

They will not checklist their mortgage costs otherwise bank costs on line, which is not atypical. But I do promote loan providers kudos when they do. Its a bonus regarding a transparency view.

So we don’t know just how aggressive he could be prior to other lenders, nor do we know if they costs a loan origination commission, underwriting and you may operating charge, software commission, etc.

Definitely ask for any charges after you earliest https://paydayloancolorado.net/hayden/ talk about financing costs with an interest rate administrator.

When you are getting a rate estimate, that along with the bank charges makes up the financial Annual percentage rate, which is a better way to examine financing can cost you from financial so you’re able to bank.

One example offered a two/step one buydown to three.5% on the first 12 months, cuatro.5% inside year a couple of, and 5.5% repaired on kept 28 ages.

That’s rather difficult to beat when financial prices is next to eight.5 today%. It is one of several benefits of utilising the builder’s lending company.

But as usual, take the time to shop your own rates with other loan providers, credit unions, mortgage brokers, etc.

Inspire Home loans Studies

However, he has a 1.8/5 toward Yelp from about 30 product reviews, even though the decide to try dimensions are definitely slightly short. During the Redfin he has a better cuatro.4/5 out-of eight evaluations, and this once again is a tiny attempt.

You may want to research its private organizations in the nation on the Google to see critiques because of the place. This is alot more beneficial if you are using a particular local work environment.

Its mother or father organization has actually an enthusiastic A+’ score towards the Better business bureau (BBB) web site possesses already been accredited as the 2015.

Regardless of the strong letter amounts score, they will have an awful step 1.05/5-star score considering more than 100 customers evaluations. This could pertain to its several grievances submitted over the years.

Make sure you take care to search through some of these to see how many pertain to their credit division rather than their new home building equipment.

Without a doubt, its likely that whenever you are playing with Motivate Mortgage brokers to find a beneficial home loan, you are together with to find an effective Century Organizations possessions.

To help you sum anything up, Promote Mortgage brokers gets the latest technology, an excellent array of loan programs, and can even promote costs deals you to exterior lenders are unable to take on.

He has specific mixed evaluations, however, generally confident of these, regardless of if your distance may differ based on the person you focus on.

Nonetheless, take care to store third-class loan providers, agents, banking companies, an such like. Along with other offers at hand, you could potentially negotiate and you can potentially property an amount finest offer.