Advantages and disadvantages regarding a deed off Trust:

The latest trustor, also known as the brand new debtor, ‘s the individual otherwise organization exactly who receives the mortgage and guarantees the property as the collateral. a knockout post The newest trustor is lawfully responsible for settling the loan according to the fresh new assented-upon terms.

Beneficiary:

New recipient ‘s the bank otherwise organization that provide the mortgage with the trustor. It hold a great need for the house before loan is actually paid off. If there is standard, the beneficiary contains the directly to begin property foreclosure proceedings to recuperate their resource.

Trustee:

New trustee try a natural third party accountable for holding judge name towards the assets up until the loan try met. The fresh new trustee’s part should be to operate about best interest out-of both trustor and the beneficiary, ensuring that the fresh new terms of the newest Deed out of Believe are upheld.

Promissory Mention:

An excellent promissory note was a unique document associated the fresh Deed out of Believe. (more…)

- Published in payday loans cash advance no credit check

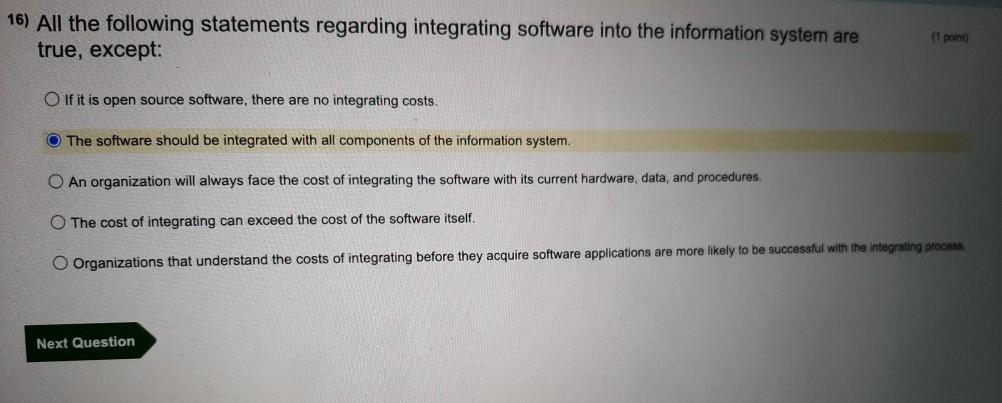

Your credit score was a major factor whenever obtaining financing

Credit history Criteria

This is because it offers loan providers a look into how good you have been in a position to pay back your own borrowing in earlier times, providing them evaluate how almost certainly you are to expend right back brand new mortgage.

A lower credit rating implies possible risk to loan providers, which may lead them to refuse the job otherwise accept theythat have highest rates and other situations in place.

Given that FHA funds try insured of the federal government, lenders commonly equally as concerned with the danger your twist. Lowest credit history conditions to have FHA loans have a tendency to cover anything from 500 so you’re able to 580sensed Poor on the lower avoid away from Fair Credit scoresaccording to measurements of the down-payment.

Financial Insurance rates

Private Mortgage Insurance rates, or PMI having quick, is a way lenders can protect themselves if you don’t repay your loan. (more…)

- Published in payday loans cash advance no credit check

The speed reduction having Car Shell out could be available merely while you are your loan was subscribed to Auto Pay

You can enjoy the Automobile Shell out interest rate prevention because of the setting up and you can maintaining energetic and automatic ACH detachment from the loan percentage. Rate of interest bonuses having making use of Auto Spend may not be mutual having specific personal education loan cost software that also render a keen interest rate protection. Having multiple-party loans, just one team will get join Automobile Pay

- Published in payday loans cash advance no credit check

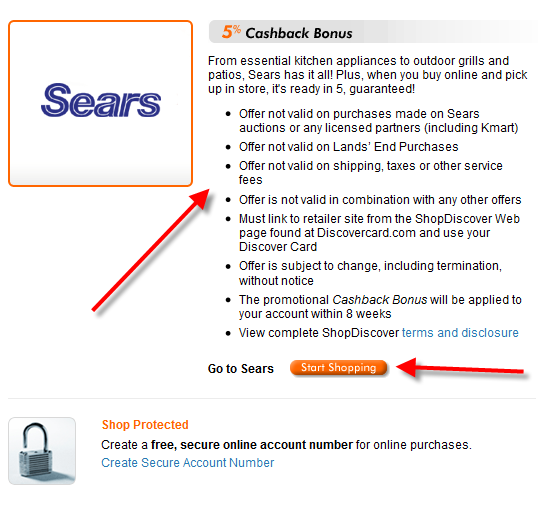

Solution Home loan Choices that don’t Need a 20 percent Deposit

Whenever you are thinking about to invest in property but concerned that you cannot meet with the minimum deposit standards, there clearly was very good news. Sure, discover reduce payment solutions compared to practical 20%.

If you’re a 20 percent advance payment features traditionally started the standard for new homeowners, times features changed. Nowadays, lenders offer numerous reduce payment applications. You can find selection requiring only 5 percent, step three % or even 0 percent off, together with very first-date homebuyer applications you could make the most of. As minimal advance payment may differ from the financial and you will home loan program, let’s evaluate where 20% advance payment shape appear off.

When you’re with a top deposit, you are and additionally decreasing the amount of money you are borrowing from the bank an obvious, however, essential section. It will help to decide your loan-to-well worth proportion (LTV), and this conveys how much cash it is possible to are obligated to pay on your loan when you spend the advance payment. So, a higher advance payment returns a lesser LTV proportion and you may mortgage loan providers think about your LTV whenever granting your mortgage application.

So you’re able to illustrate how your deposit number may affect the monthly payment, look at the analogy lower than, and that compares the minimum down payment (5 %) on a normal mortgage so you’re able to a 20 percent down-payment:

- Published in payday loans cash advance no credit check