Precisely what do You really need to Qualify for Individual Currency Funds inside California?

The fresh new median family rates within the California is anticipated to drop notably in the 2023. You don’t want to skip a bona fide property possibility. If traditional mortgage loans cannot do the job, you may have other options.

Personal currency funds give you a whole lot more independence to discover the capital you desire. Being qualified to have a challenging money loan may be much easier than just your envision. Keep reading to find out more.

Exactly why are Individual Currency Financing Other?

A private difficult money mortgage is a kind of secured mortgage. It can be used buying tough property including home. The house you intend buying functions as guarantee into the loan.

A personal loan provider primarily basics the terms of the mortgage toward value of the house as opposed to the borrower’s credit. Thus, you’ll be able to look for hard money fund named bad credit fund.

Conventional lenders dont render tough currency finance. Difficult currency lenders is individuals or businesses that comprehend the value in this style of probably high-risk financing. Potential lenders are:

- Owning a home loan providers

- Collateral people

- Asset lenders

- Trader teams

There are high, national loan providers including faster regional ones. A nearby lender may offer personal qualities you will never rating regarding a bigger providers.

How exactly to Be eligible for a private Currency Mortgage

The needs to own qualifying for an exclusive currency loan confidence the financial institution. not, hard money lenders always consider standards for example:

- Security on the property

- Loan-to-value ratio

- Capacity to pay

- A residential property experience

Bringing an exclusive real estate loan will not depend on with a good credit score. However, personal loan providers might look at the credit history. Particular lenders features the absolute minimum credit demands.

This can be more prevalent if you intend so you’re able to rent out the fresh assets as opposed to turning it right away. You should make payments to your mortgage even when you may have clients. This is riskier for the lender.

Guarantee from the Possessions

The home you’re to invest in ‘s the equity to the loan. You will want a higher down-payment compared to a classic home loan. New down payment lowers the risk with the bank.

An exclusive loan provider can sometimes need a down payment equivalent so you can twenty-five% to help you thirty five% of the complete amount borrowed. The lender loans Yellow Bluff AL may take into account the precise location of the property and your a home sense whenever calculating your own deposit.

Loan-to-Well worth Ratio

The down-payment are directly pertaining to the loan-to-well worth (LTV) proportion of your own a property transaction. The latest LTV compares the worth of the home we would like to purchase toward amount we wish to obtain. A reduced LTV make the loan less risky to your lender.

The lending company are able to use the fresh new shortly after-resolve really worth (ARV) to estimate LTV. Utilising the ARV is normal to own qualities into the bad condition you to definitely this new debtor plans to resolve.

Difficult currency lenders usually provide fund having an enthusiastic LTV away from 65% so you’re able to 75%. For this reason their advance payment have a tendency to usually feel twenty five% to thirty five%.

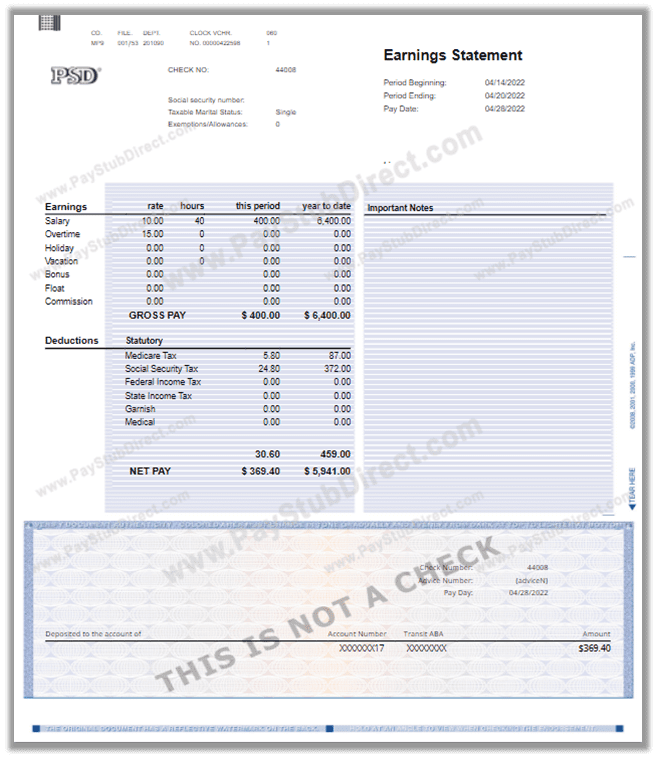

Ability to Pay off

You could have fun with papers of your own total financial stamina, particularly most other assets or dollars. The lending company investigates their exchangeability. You’ll want to show that you have got adequate money on hand to pay for mortgage costs including:

- Closing costs

Real estate using has actually recognized and unfamiliar costs. The greater water reserves you have got, more pretty sure the lender will be in granting the loan software.

A home Sense

Real estate experience is not always a significance of delivering an arduous currency loan. Although not, the lender is more browsing approve your application. You can get a much better financing price.

It does not matter their number of sense, you could improve your chances of mortgage approval by creating a good reasonable installment bundle. You desire a definite hop out strategy for profiting from the home.

Typically the most popular hop out strategy is selling the house within the mortgage period. You can also refinance the tough money financing to a normal that or sell off most other investments to repay the loan.

Benefits of a private Real estate loan

Using an exclusive home loan company has experts dependent on your role. Difficult currency financing will likely be a good fit for many who don’t be eligible for a timeless home loan. A personal lender is a good choice for domestic flippers and you can local rental property investors.

It’s not necessary to have Best Borrowing

One of several great things about a private money financing is actually that the financial doesn’t have confidence in your credit score. Bad credit financing offer the possibility to financing the real estate purchase whenever traditional money do not.

Romantic the mortgage Faster

Private financing personal faster than conventional of them. The lender doesn’t need a thorough and day-sipping post on debt history. You are accepted within this months.

California provides a highly drinking water market. A more quickly loan procedure enables you to make use of a property solutions as soon as they getting available. You do not dump earnings awaiting mortgage documents.

Obtain the Amount borrowed You would like

Having a traditional home loan, you get pre-acknowledged to possess a particular loan amount. Then you’ve discover a house that suits you to definitely count.

An exclusive home mortgage will be based upon the worth of the latest assets. You have made what kind of cash you need.

Use the Correct Individual Difficult Money lender into the Ca

Individual currency financing are a good choice a number of points. Certain requirements to help you qualify is simple. You would like a loan-to-really worth ratio therefore the capacity to pay the mortgage.

Stonecrest ‘s the certified private bank you are looking for. We have been authorized and possess experience with the new California real estate market.

You can expect terms of a dozen to 60 months for up to 65% off LTV. You might use around $5 mil depending on your situation.