Navy Federal Borrowing from the bank Connection financial rates now

Mortgage loans can be gotten to have features all over the country. Navy Government Credit Partnership services mortgage loans towards the lifetime of the fresh financing. They do not sell affiliate mortgage loans some other banking institutions or companies. The credit connection has the benefit of a number of apps to have pros and you may basic-go out buyers.

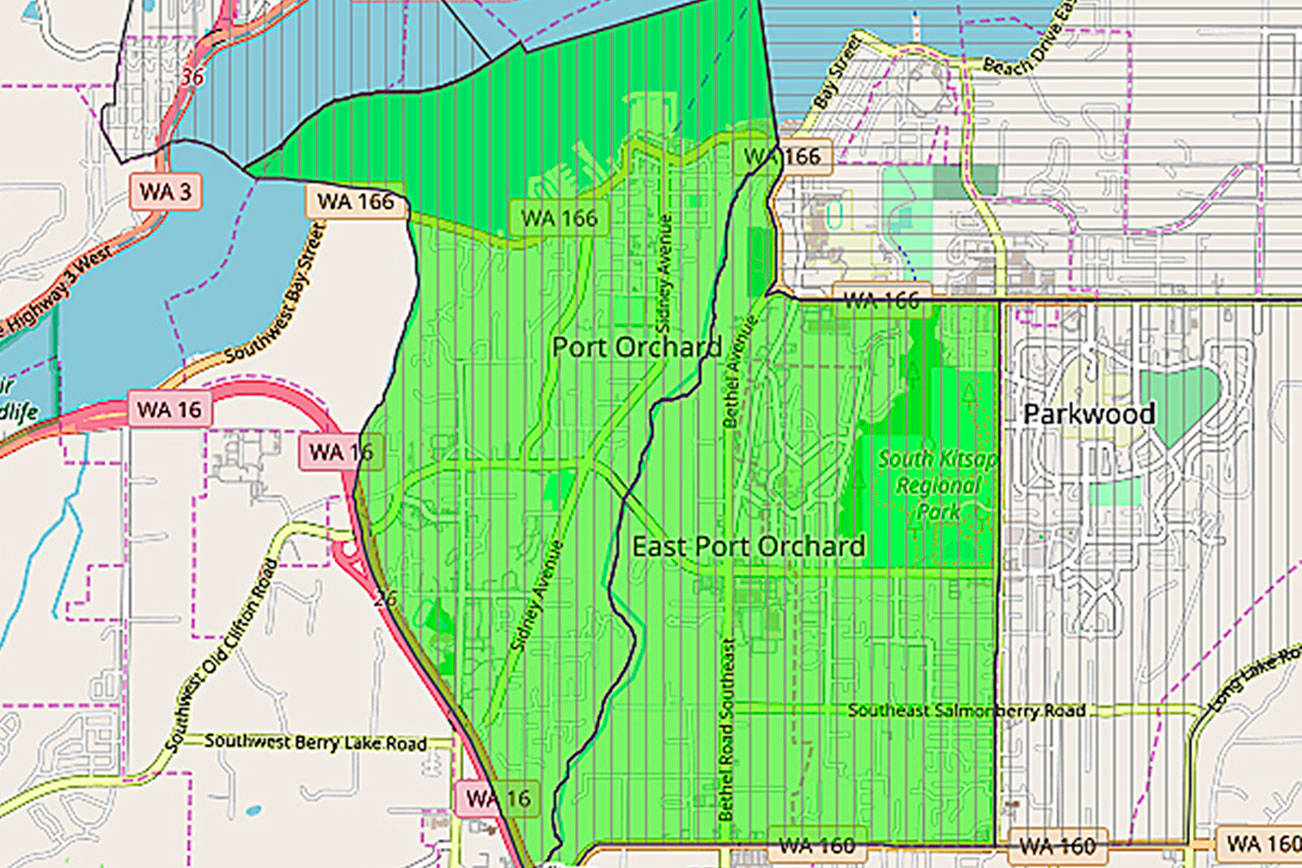

Nfcu re-finance prices can help you save cash on their re-finance. He’s excessively flexible to effective duty military exactly who are stationed in the future. (Photo/Wikipedia)

While some financial institutions to take into consideration low-old-fashioned types of credit score, like the number of for the-day book payments, Navy Government Union requires it one step then. This borrowing from the bank relationship also investigates energy and you may cell phone payments when deciding good borrower’s qualification and you will costs. That is incredibly ideal for consumers in order to secure the lower costs, and in turn save money across the long run.

This new estimates offered towards the Navy Government Union’s web site aren’t customized pricing from the geography, credit rating, or other information. To acquire current and you can designed cost to suit your finances, you’ll want to phone call Navy Federal myself.

How does Navy Federal Commitment re-finance cost compare with most other banking companies?

USAA against. Navy Government: Comparing both of these military-centric loan providers is a superb means to fix observe how your own armed forces condition can impact your own mortgage pricing. One another organizations tout a reduced costs for their professionals, and both lenders carry out 50 % or even more of their home loan business from Virtual assistant.

One important aspect to take on just before refinancing ‘s the settlement costs. And you will head to head, Navy Government can not contend with USAA about front side. USAA has the benefit of no commission IRRRL and less origination fee. (Currently, Navy Government fees good .fifty percent. high origination fee.)

Navy Government Borrowing Union vs. Nationstar : If you enjoy a personal experience of your lender, Navy Federal would make even more feel since a lender than just Nationstar. Currently, Nationstar has no branch towns, which will make they more difficult to try out an effective consumer/bank relationship. With regards to unit reviews for every single organization tries to let you know its individual flare. Nationstar focuses on user books they provide a number of citizen systems and you may informative advice. Navy Government takes a monetary incentivization position they offer an effective $step 1,one hundred thousand financial price match program.

Navy Government Borrowing from the bank Connection vs. Wells Fargo : Even although you qualify to own a specialty borrowing from the bank connection like Navy Government it’s value contrasting how a national bank stacks up. If you find yourself already, a good Wells Fargo consumers you covered refinance alternative for example no closing costs or app and you can appraisal costs towards customers. This helps counterbalance the will set you back out of refinancing, which will make up the distinction regarding a lesser full interest speed fundamentally. Navy Government doesn’t already provide an improve unit.

Extra considerations to decide if a great Navy Government re-finance is actually for your

Players can also be re-finance its mortgage which have Navy Government Borrowing from the bank Partnership to own doing 97% of residence’s loan so you can well worth ratio. Most antique mortgages do not require brand new consumers to get individual financial insurance coverage. No pre-payment punishment costs implement for individuals who spend the financial regarding early otherwise decide to re-finance once more.

FHA loans promote various other affordable financial option. Navy Federal Borrowing from the bank Commitment even offers FHA mortgages due to the fact a beneficial refinancing option as well in case your first mortgage is actually having an alternate financial. FHA installment loans Tennessee bad credit mortgages want a minimal deposit, making them an appropriate option for several borrowers. The loan amounts available confidence the region of the house. FHA funds commonly allow it to be a lot more versatile financing certification standards.

You’ll have to go through enough information in advance of settling with the greatest re-finance device for your requirements. Use a home loan calculator to include upwards all costs out-of a good refinance: settlement costs, the latest interest levels and you will monthly premiums. You are amazed observe one even a lender having highest closing costs can help to save the absolute most currency over the movement of one’s loan.